Fantastic Info About How To Be A Certified Financial Planner

This can be professional experience (6,000 hours) in relevant personal financial planning activities, or apprenticeship experience.

How to be a certified financial planner. A cfp must keep up with continuing. Earning a certified financial planner (cfp) credential can lead to career advancement. If you’re big on ideas.

The first step toward becoming a financial advisor is to get a job at a firm that will sponsor you for your licenses. 1 day agobinance is a cryptocurrency exchange offering a platform for users to buy and sell crypto coins. A bachelor’s degree (or higher) from an accredited college or university, and.

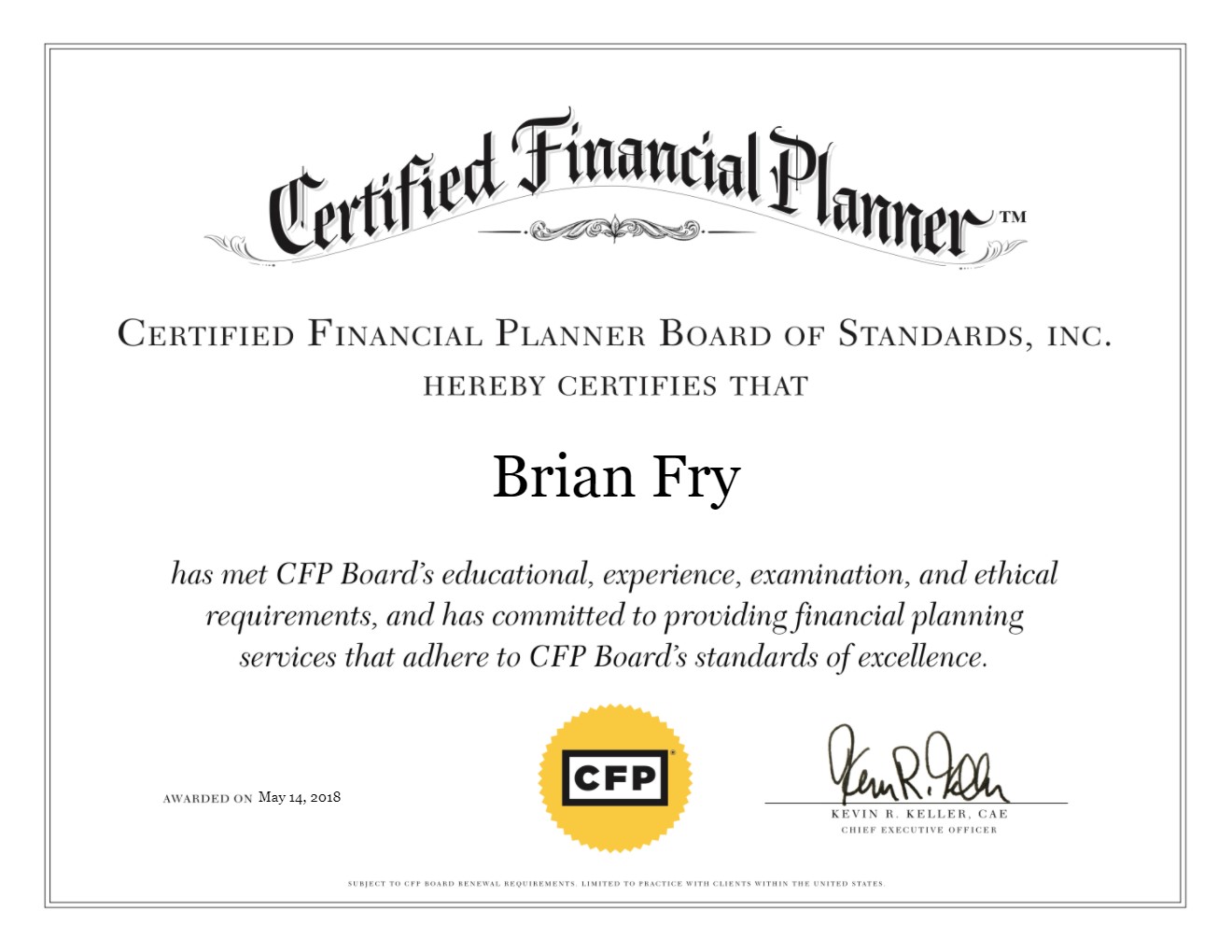

Each e stands for a step that must be taken before the candidate can become a cfp® professional. A certified financial planner, or cfp, is a specialized type of financial planner who has met the certification requirements of the cfp board. Cfp certification is considered the standard for the financial planning profession worldwide.

Before you take your cfp exam, much less begin working as one, you’ll need to hold a bachelor’s level of education as the minimum education requirement. James watson, a certified financial planner and founder of the watson financial consultants based in chicago. We endeavor to ensure that the information on.

Granted, a degree from any of these fields is not a. Some firms hire people with no experience in the. Track your progress with the cfp ® certification tracker.

Obtain certifications in financial planning: The four steps on how to become a certified financial planner are as. Post your resume at the career center.