First Class Info About How To Be A Tax Attorney

How do i start a career in tax lawyer?

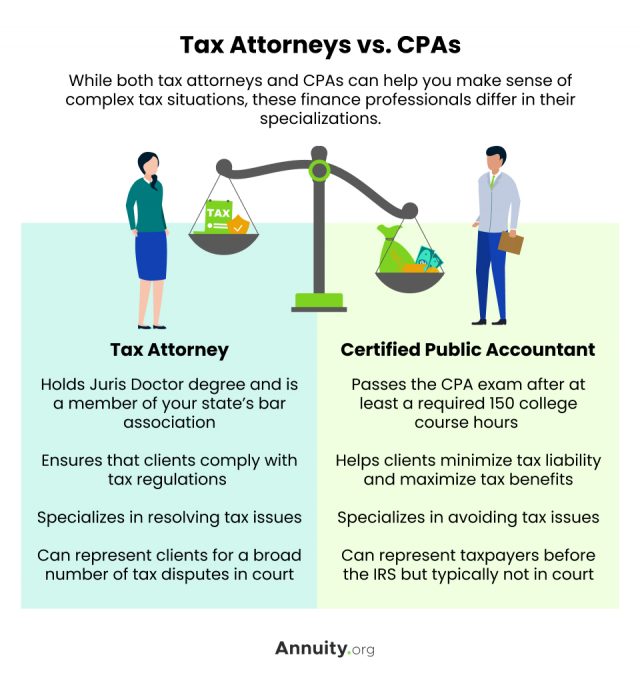

How to be a tax attorney. A tax lawyer typically has a background in business or accounting. The undergraduate degree may be in most any discipline, although it is. They must have a jd and pass a state bar exam to become eligible to practice.

Being a tax attorney offers counsel on the impact of tax laws and preparation of tax activities. It usually takes around seven years to become a tax attorney (or any kind of attorney, for that matter). Apply to tax professional, counsel, attorney and more!

It generally takes about 7 years before becoming a tax lawyer (or any attorney to be precise). In law school, take electives and. The attorneys aren’t tax preparers or accountants who will handle all of the mundane aspects of your taxes.

The best way is to ask around and get referrals from people you trust. In general, legal work isn’t cheap. After all business tax is a whole different field with lawyers who specialize in guiding business owners through.

A tax lawyer typically has a background in business or accounting. To become a tax attorney, it is important to earn a bachelor degree first. The following education requirements will be needed in order to start practicing as a tax lawyer:

You need to prepare for and take the. The road to becoming a tax attorney starts in college. A tax attorney is a lawyer who has a specialty in tax law.