Inspirating Tips About How To Become A Certified Tax Preparer

How to become a professional tax preparer:

How to become a certified tax preparer. You need to have a preparer tax identification number or ptin through the irs to become a tax preparer. Create your ptin anyone who prepares tax returns and charges a fee for their services is required to have a preparer tax identification number. The accredited tax preparer® (atp) designation requires passing.

Choose the ctec tax preparer training that's right for you. To do so, fill out an application and include personal information, such. Enrolled agents an enrolled agent is a registered tax return preparer required to pass a suitability check, take an extensive test covering individual and business.

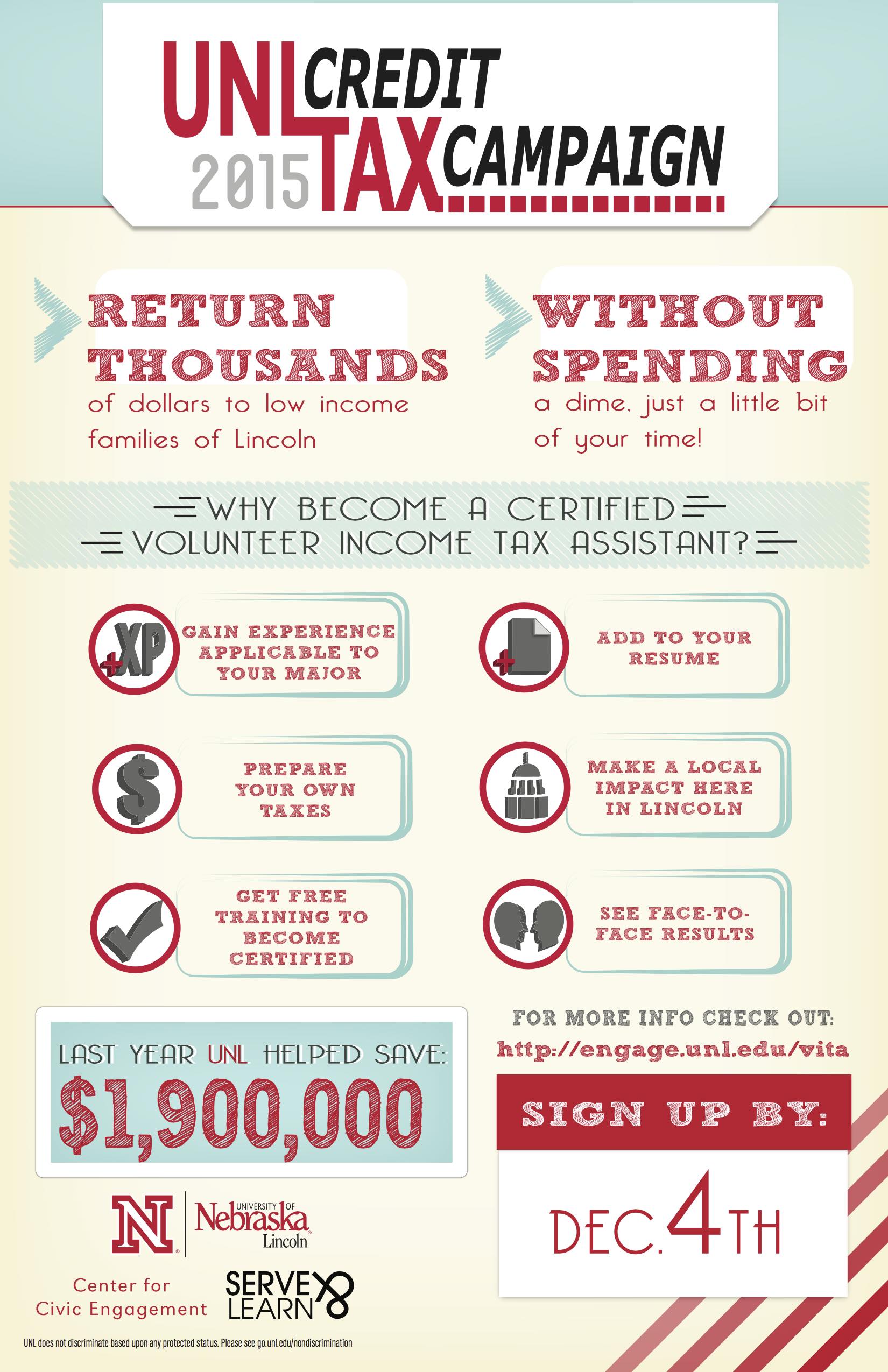

Your enrollment in the ptp certification program extends even after. How to become a certified tax preparer each year, tax preparers help tens of millions of americans prepare and file their taxes. Upon qualification, you become certified as a professional tax preparer and are licensed to use the (ptp) designation.

They use their experience and expertise to. Make sure you have right skills for tax preparer. We offer this course online so you can take it in the comfort of your own home, at your own pace.

To become a ctec certified tax preparer you must first complete a ctec 60 hour course. Tax professionals who must register? Visit prometric’s special enrollment examination (see) webpage to schedule your test appointments, review the see.

Obtain a preparer tax identification number (ptin). To become a ctec registered tax preparer, you must: California law requires anyone who is physically in california and prepares (or assists with) tax returns for a fee, and is not an attorney, certified.