Great Info About How To Become A Cpa In Indiana

![Indiana Cpa Exam & License Requirements [2022]](https://img.youtube.com/vi/oALqIIziJvc/sddefault.jpg)

To get your license and appear on the indiana cpa license lookup, you must obtain a bachelor’s degree or higher from an accredited college.

How to become a cpa in indiana. Valid social security number required. 24 credit hours logged in. You may register online via credit card.

Not required to be a us citizen. Not required to be an in resident. Cpa candidates must complete these cpa license requirements to become licensed in indiana:

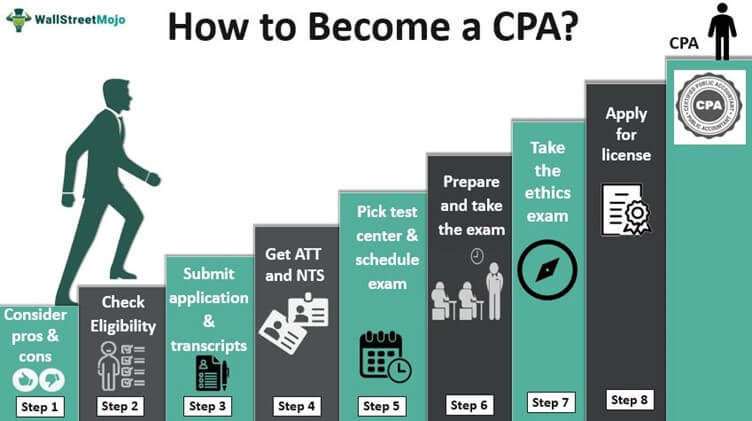

Learn the 7 simple steps to qualifying to become a licensed cpa in indiana: How do you become a licensed cpa in indiana? Cpa certification requires at least a bachelor’s degree (150.

To apply for the cpa examination online, you will be asked to create a user account upon your first usage of our online application tool. The best answer for how to become a cpa in india is complete devotion and finding the apt guidance! Start free trial overview of indiana requirements 150 semester.

Ad pass up to 4x faster with our adaptive technology. To be awarded an indiana cpa license, you will need to have the proper educational background. Meet the education requirements in indiana submit your cpa exam application in indiana.

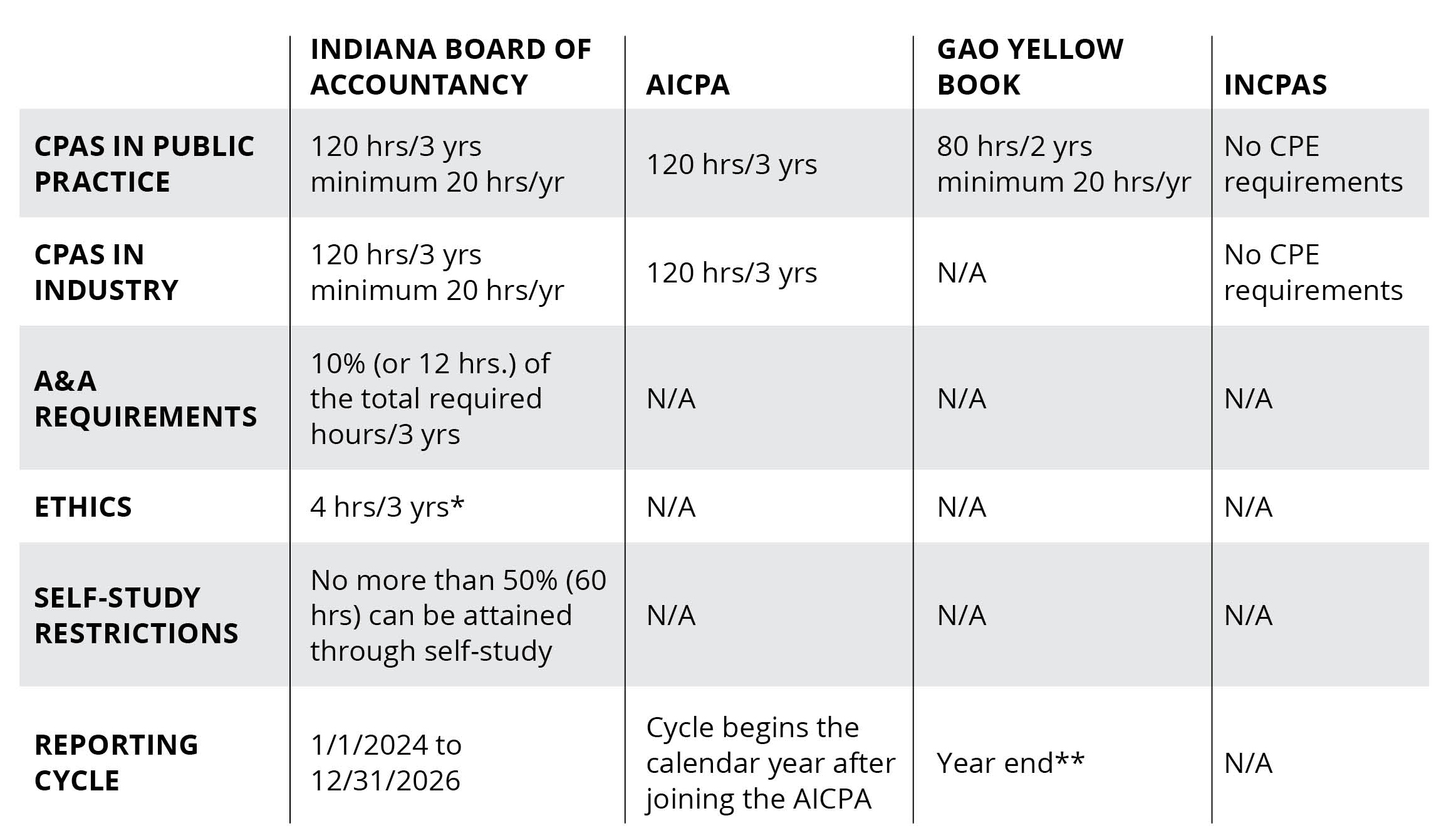

The indiana board of accountancy grants two different licenses to those who work to become public accountants in the state: Indiana requires a minimum of 150 semester hours that have culminated in at least an. The indiana board of accountancy (the board) oversees the process for becoming a cpa in the state.

![Indiana Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/Indiana-CPA-License-Process.jpg)

![Indiana Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/Uniform-CPA-Exam.jpg)

![Indiana Cpa Experience Requirements [2022]](https://www.superfastcpa.com/wp-content/uploads/2022/06/Indiana-CPA-Experience-Requirements-1024x576.png)

![Indiana Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/Indiana-CPA-Exam-License-Requirements.jpg)

![2022] Indiana Cpa Exam And License Requirements [Important!]](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2019/05/Indiana-CPA-Requirements.png?fit=640%2C400&ssl=1)

![2022 ] Indiana Cpa Exam & License Requirements [Important Info]](https://crushthecpaexam.com/wp-content/uploads/2019/06/UStates-Images-28.png)