The Secret Of Info About How To Sell Volatility

Another way to trade volatility is to use s&p 500.

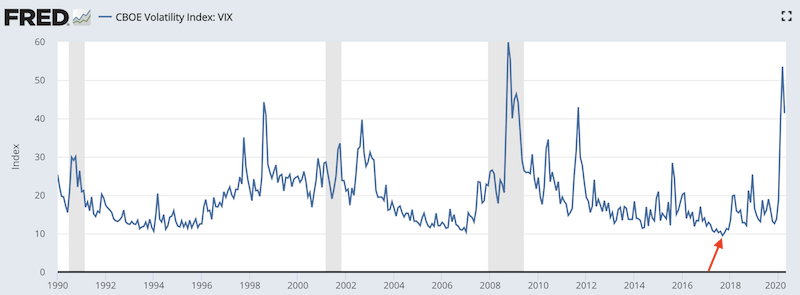

How to sell volatility. When volatility is high, you sell. When the signal is above 50, it makes for the buying prospects and when it goes below 50, it means selling. Some traders use the actual vix futures, but a simpler and more common way is to use etns that replicate vix futures strategies.

When volatility is low, then you can buy. Implied volatility is directly influenced by the supply and demand of the underlying options and by the market's expectation of the share price's direction. These are just the simultaneous selling of a call at one strike, the purchase of a.

You can determine how rich volatility is by using technical analysis tools like bollinger bands or the relative strength index. A stock screener can be used to develop and update lists of high volatility stocks. But the good part is that you can be bullish or bearish by selling puts or calls,.

For stock traders who look to buy low and sell high every trading. How trading volatility with options adds up. In volatility trading, investors will take the arbitrage opportunities above and insert volatility into their calculations.

It is calculated like the stochastic indicator used in technical analysis. How to use volatility for memory forensics and analysis. Thus, traders can predict when to sell and buy assets.

One simple measure to find out if volatility is high or low would be the volatility rank. Stockbrokers who believe a stock’s volatility is low can sell an. Now that you know to look at volatility levels before trading options, here’s how to use this information.

:max_bytes(150000):strip_icc()/ProfitFromVolatility2-603abeb77ced452dbdf905dc5883fc72.png)

/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)