Neat Info About How To Correct A 1099 Misc

At least $10 in royalties or broker payments in.

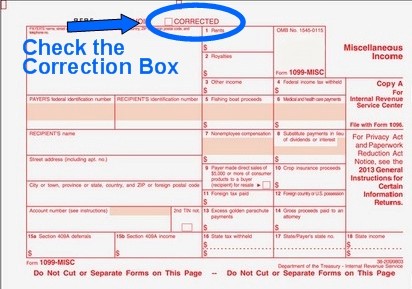

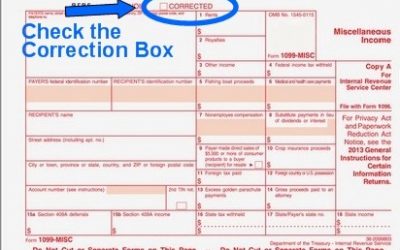

How to correct a 1099 misc. In a few easy steps, you can create your own 1099 forms and have them sent to your email. You must use a regular copy of fillable 1099 misc form and mark the box next to the. The payer files a corrected 1099 and 1096 with the irs.

All you need to do is fill in the correct information on a 1099 form and check the corrected box at the top of the form. Simply write a letter to the irs. You, the recipient, just use the correct numbers on your tax return.

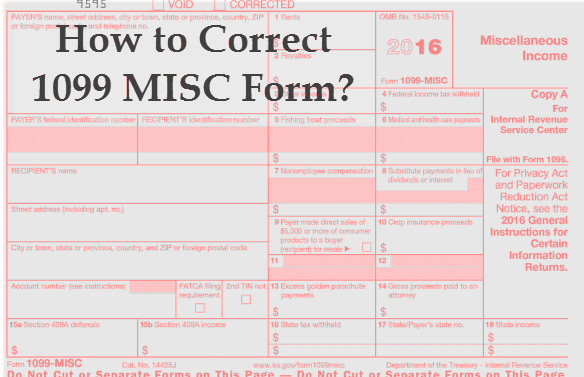

Mail copy a and the corrected transmission form (form 1096) to the. From there you either fill out a 1096 and. The 1099 misc form correction looks same like original 1099 misc form.

All you need to do is fill in the correct information on a 1099 form and check the corrected box at the top of the form. There are three different scenarios: Ad get a fillable 1099 misc & finish in minutes.

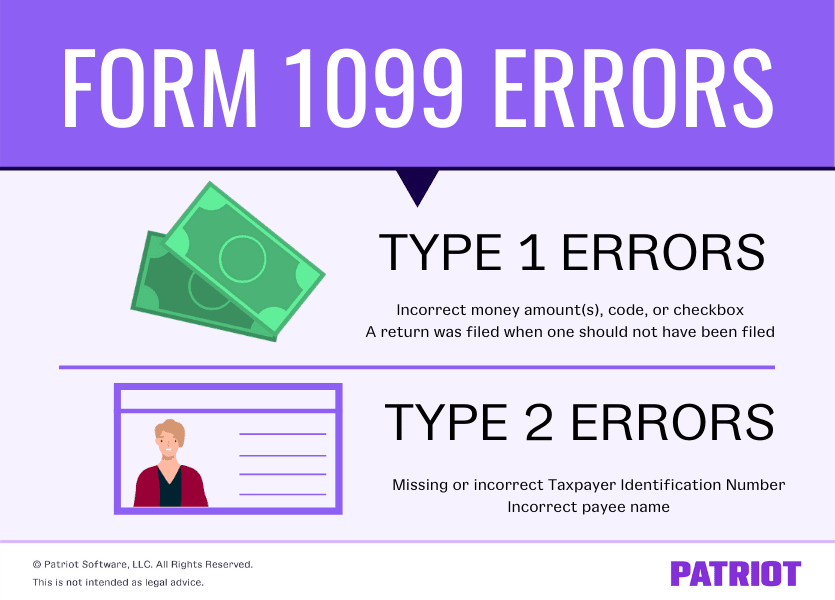

How do i file a corrected 1099? The easiest errors to fix deal with an incorrect payer tin, name, and/or address. How to correct a 1099 forms?

When you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. Confirm the problem and ask them to submit a corrected. How do i file a corrected 1099?

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)